Understanding How Merchant Accounts Work

If you run a business, then you need to accept payments from your customers. This is where merchant accounts come in. A merchant account is a special bank account that allows businesses to accept credit and debit card payments. This blog post will explain the basics of merchant accounts and answer some common questions about them.

Customers Pay With A Card

This process starts with the customer, more precisely when they decide to use their credit card to pay. Having an adult merchant account allows customers to pay with their credit card, whether it be a physical or virtual one. The customers’ card information is then transmitted to the merchant account provider where the funds are transferred from the customer’s account to the merchant’s account.

There are a few things that need to happen before this can take place though. For one, the customers’ card information needs to be verified by the merchant account provider. This is done through a process called authorization. Authorization is when the customer’s card information is sent to the bank that issued the card (the issuing bank) to see if there are sufficient funds to cover the purchase.

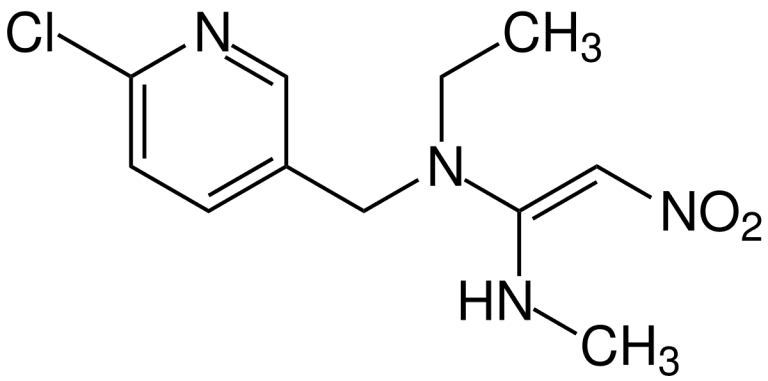

Reading Card Details

The system then reads the card information. It needs the following details:

- The account number

- The cardholder’s name

- The expiration date

- The security code

- The billing address

After reading the card information, the system checks to see if the account is active. If it is, then the transaction can go through. If it’s not, then the system will decline the transaction.

For example, if you’re trying to use a credit card that’s been canceled, the system will decline the transaction. The same is true for cards that have expired. If your card has expired, you’ll need to get a new one from your bank or credit card company.

Forwarding The Transaction

Once the details are checked, the credit card processing continues by the merchant account forwarding the transaction to the acquirer. The acquirer is basically the bank that provides credit and debit card services to the merchant. They will then send it off to the card association, which will either approve or decline the transaction.

Finally, it goes back through the same process in reverse until it reaches the customer’s bank. If all goes well, the customer will see the charge on their statement within a few days.

Responding To The Acquiring Bank

The final way a merchant service works are by responding to the acquiring bank. The acquiring bank will hold onto your money for a set period of time, usually around two days. After that, they will deposit the funds into your account. If you need access to the funds sooner, you can always contact the acquiring bank and ask for an early deposit.

Most merchant accounts will also come with a debit card. This card can be used just like a credit card, but it draws funds directly from your account. This can be helpful if you need to make a purchase but don’t have the cash on hand.

Merchant accounts are extremely useful for every business as it makes everything convenient both for customers and workers. The process explained above is pretty simple and straightforward so you shouldn’t be anxious about transitioning to this. Rather, you should be excited about it!